Myo Min Thein, 2016, International University of Japan

Introduction

In the 1970s, the Japanese economy could overcome the oil crisis and successfully achieved high economy growth. So, what features are included in the behind of the Japanese economy development? In the case, I really emphasized the role of actors which are not only the Japanese government but also private sectors how much influenced and how to try the best for their economy growth in that period. During before the bubble state and after World War II, it generally consists of three postwar periods in Japan. There are “economy under the occupation (1945-1950), high economic growth (1951-1972), and oil crisis and adjustment period (1973-1985)” (Nakamura, 2004). So, what are contributed to the extraordinary performance of the Japanese economy during before and after the oil crisis?

Introduction

In the 1970s, the Japanese economy could overcome the oil crisis and successfully achieved high economy growth. So, what features are included in the behind of the Japanese economy development? In the case, I really emphasized the role of actors which are not only the Japanese government but also private sectors how much influenced and how to try the best for their economy growth in that period. During before the bubble state and after World War II, it generally consists of three postwar periods in Japan. There are “economy under the occupation (1945-1950), high economic growth (1951-1972), and oil crisis and adjustment period (1973-1985)” (Nakamura, 2004). So, what are contributed to the extraordinary performance of the Japanese economy during before and after the oil crisis?

During the 1950s to 60s, due to the high economic growth of Japan, the Japanese economy strengthened supply-side economy and the government of Japan designed the mid-term and long-term strategy to guide vital investment activities in the private sectors, and it also called “post-war Japanese high growth miracle” (Katz, 1998). Especially, the government of Japan tried to handle the large demand for the Japanese products by recognized groups among the companies. Nevertheless, the high growth era was terminated in the early 1970s because of the Nixon shock and oil crisis. In 1971, the consequences of the Nixon shock, the US faced to hardly maintain their US Dollar base gold standard and also the international monetary system has shifted to the full-floating system. Therefore, the Japanese currency rate also increasingly appreciated from 36 yen/$ to 240 yen/$ during 1972 to 1985 shown in figure 4. Therefore, what I found a result that the export product of the Japan have been lost and it obviously faced price competition in the international market. Consequently, Japanese government terminated the long-term development plans and introduced efficient income policy in order to improve the hyperinflation.

Source: National accounts of Japan, IMF library retrieved may 18, 2016 from http://data.imf.org/?sk=b5cda530-07b8-46c6-b829-1827df8b49c7&ss=1390030109571

In 1973, the OPEC countries increased their export prices of crude oil from $4 per barrel to $12 per barrel. Relatively, as the increasing the oil prices to five-fold, high rate of international inflation appeared in 1974. The increasing oil price was suddenly impacted as a shocked to the rest of the world and their industrial economies faced both stagnation and inflation (Nakamura, 2016). On the other hand, The Japanese economy was also no exception because of the industries of Japan heavily depended on the imported liquid fuel estimate 90 percent of their energy demand and the other side as their insignificant domestic supply of energy. In that situation, what I found that the highly increasing of the Japanese economy was ended as the increasing of oil price and the Japanese economy suffered hyperinflation and economic stagnation. In that time, the Japanese government implemented the income policy to improve hyperinflation by reducing real wage rates in the private sector. Therefore, in figure 3, both the wage income share (YW) and corporate income share (YC) were pointed opposite direction during the half of the 1970s and also it’s designed whereas the private consumption. Therefore, due to the situation, the demand-side economy was decreased because the income distribution pattern between wage income and corporate income influenced not only the demand-side but also supply side economy in Japan. On the other hand, according to the situation purchasing power parity (PPP) also decreased and investment consumption also increased. Moreover, the capital stock also affected the private consumption and it led to increasing the supply side economy. Therefore, as the Japanese economy accepted this income policy and reducing real wage rates were obviously affected to overcome oil crises at that time.

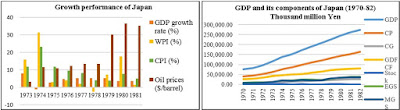

Consequently, international supply and demand conditions for primary commodities were tight and Japanese wholesale prices had increased by more than 15 percent over the past years. In 1974, the wholesale price index (WPI) and the consumer price index (CPI) rose twice over the previous year as shown in figure 1. Fortunately, Japan’s economy recovered in 1975 and their GDP also increased and the growth rate climbed 5 to 6 percent per year until 1980 (Nakamura, 2016). Therefore, I focused what are the influence of overcoming the first oil shock and how they managed the great solutions in the Japanese economy. In that case, the Japan well-known for their insufficient endowment of non-human natural resources and they used treatment by adopting the tight income policy and they tried to maintain income distribution pattern and balanced between supply-side and demand-side economy.

If I continuously focus on the second oil crisis In 1978 to 1980, the consequences of the Iranian revolution in the Middle East situation and after the Iran-Iraq war in 1980, it has resulted that the oil prices jumped from around 12 $/barrel to around 35 $/barrel in 1981 by yearly increased (Nakamura, 2016). The second oil crisis also hardly impacted on the economies of oil consuming countries. However, the Japan had survived as their good preparation with their creative thinking related with monetary and fiscal policies.

Figure 3 and 4 Ratio of wage income and purchasing power parity 1970-80 and exchange rate after oil crisis

Source: National accounts of Japan, IMF library retrieved may 18, 2016 from http://data.imf.org/?sk=b5cda530-07b8-46c6-b829-1827df8b49c7&ss=1390030109571

The consequences of the facing oil crisis in japan, the ratio of labor share declined after overcoming first oil crisis and it could increase the supply side economy as shown in the figure3. Moreover, real wage rate changes were affected on the purchasing power parity. However, the Japanese income policy covered not only public sector labor market but also private sector labor market. Additionally, the Bank of Japan introduced inflation target and monetary target policy just after the second oil crisis to manage the acceleration of inflation. In 1973, due to the Bank of Japan raising the official discount rate , the required reserve ratio was raised several times and the bank providing was tightly controlled through “window guidance” (Nakamura, 2016). The Japanese society also accepted the income policy and lower nominal wage increasing in labor- management relations in the half of the 1970s. However, even after overcoming the oil crisis, real wage rates have been distorted and demand stagnation was continued in japan. Therefore, the controlling of inflation became a top priority of the government policies, and public opinion demanded the monetary authority to control the inflation.

Source: Professor Nakamura, O. (2016). The Postwar and Japanese Economy. Lecture Note the Japanese Economy in the 1980s, Plaza Accord, Asset Bubble and Bursting of Bubble Economy, Table 2.1

In my discussion, in early 1975, the Japan stopped declining and began improving their economy growth. In terms of consequences of the first oil shock on Japan, I note first that the depending of foreign oil was became a question of national security and the Japan understood their vulnerability causes of the evolutions of international fuel price and they reorganized all their industries. Therefore, these case pushed the Japan forcefully and the Japanese towards research in the field of maintaining raw materials, energy and the substitution of energy saving products. Therefore, some new type of industries became advantaged and the Japanese had been focused on integrated circuits, computer machines, industrial robotics, electronic materials, etc. Moreover, I note second that the case of the hyperinflation, the Japanese government implemented several macroeconomic policies related with private sectors in the 1970s. Therefore, the income policy and monetary policy played very important roles to stabilize the hyperinflation and Japanese economy could overcome oil crisis including they try to balance between supply-side economy and demand-side economy of their country.

Continuously, I would like to examine the Japanese economic performance in the oil crisis and concludes that the some important factors were contributed in their achievement. Especially, there are stringent monetary and fiscal policies to controlled union's wage demands of the labor market, energy-saving facilities and quality control techniques of the industries investments and these are also related to their energy-specific policies. Moreover, I found that the Japanese government changed from energy-intensive to high-technology and knowledge-intensive production in their industrialization with the expansionary policies during the oil crisis period. Furthermore, the Japanese corporations also strengthened their industrial structure to minimize the depending of oil demanding and supplied the hot-selling products to the world market such as numerically controlled machine tools, home electric appliances of superior performance with convenience and attractive design and energy-saving automobiles. Furthermore, Japan overcame the external shocks with the a lot of benefit such as achieved the structural changes, developed high technology and supplied hot-selling products and had a good economy lesson.

In conclusion, the Japan had overcome oil crisis and hyperinflation by adopting their tighter fiscal and monetary policies and they successfully shifted their manufacturing industries to an energy-saving industrial structure and energy saving goods and services had been produced by innovated technology. Moreover, Japan was able to manage the rising of oil prices and the international competitive market by implementing efficient policies within a short period of time. As a result, Japan had been achieved better performance than other major countries especially the United States and the Japan strengthened their international market. Finally, I assumed that the Japan designed the innovated strategies and they used the unity power of the government and citizen to overcome the oil crisis in the 1970s.

References

International Monetary Fund (IMF), (2016). National accounts of Japan, IMF library retrieved may 18, 2016 from http://data.imf.org/?sk=b5cda530-07b8-46c6-b829-1827df8b49c7&ss=1390030109571

Katz, R., 1951. (1998). Japan: The system that soured: The rise and fall of the Japanese economic miracle. Armonk, N.Y: M.E. Sharpe.

Nakamura, M. (2004). Changing Japanese business, economy and society: Globalization of post-bubble japan. Basingstoke: Palgrave Macmillan.

Nakamura. O. (2013). Income distribution and economic growth of Japan under the deflation economy. World scientific.

Nakamura. O. (2016). Lecture note the Japanese Economy in an Adjustment Period with Nixon Shock, Oil crisis and Yen Appreciation, Postwar and Japanese economy, International University of Japan

Shigeru T. O. (2007). Post-war Development of the Japanese Economy. For students in the EDP&M Program.

Wataru. T. (2011). Japanese financial sector's transition from high growth to lost decades. Market economy perspective.

No comments:

Post a Comment